(written on April 2011 ..comments on HK property market 2012? need some input for next week hah thanks a lott~~)

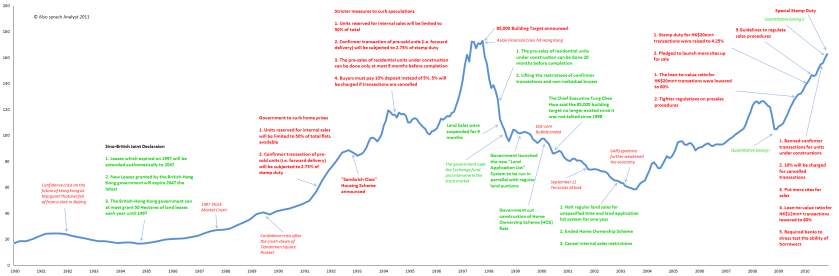

(1) 13-year high: End of property market bull cycle in 2011?

- HK residential property price has already exceeded the peak sky-high price before the 1997 property bubble burst

- ..and is still steadily soaring. Home prices increases by 60% in 2 years.

- No. of real estate agents surged by about 40% in one year ..even my aunt decided to quit her job and join the league.

- The highest-paid fresh-grad job in Hong Kong no longer goes to doctor or lawyer — In Class of 2010, a private property investor with 100K HKD monthly income topped the list.

- In 2011, HK has the highest home prices and income disparity in the world.

Reasons:

- Shortage of land, properties and public housing

- Dominance of giant developers: win land auction everytime and construct luxury apartments.

- Influx of mainland investors and cash flow: buying in HKD is a cheap 20%-off deal to mainlanders

- Low borrowing cost/interest rate environment

- Currency peg: QE 1 and QE 2, weak dollar = weak HKD.

- real buyer VS speculators: local buyers could never pay their first installment with speculators pushing up prices.

Cooling measures:

- Quarterly land auctions: the government is proposing a regular schedule for land sales + 12 land sites release to further boost supply

- Additional stamp duty on short-term sales: sellers are subject to a 5-15% additional stamp duty if they resell their homes within 2 years to discourage speculation.

- Tightening borrowing requirement in banks: banks raised mortgage interest rate and down payment

F1oni’s forecast:

- It’s about time. Say no to Keynesian–follow business cycle and let it burst.

You might be interested in:

(2) Why does Yen appreciate after earthquake? (March 13, 2011)

jue

27 度 already?熱過香港,上機未?二天後見kissss

太古的 development 部份其實唔係佔好多

主要收入來源是 rental income – office and shopping mall

shopping mall (Cityplaza, Pacific Place, Citygate) 客戶主要為香港人, department store (Lane Crawford, Apita) 佔了 shopping mall rental income 主要部份

office 就不在中環 (Quarry Bay, Wan Chai, Admiralty), 比 HK Land 空置率為低

皆為 defensive

仲有, 其現有 development projects 大部份為西半山豪宅, 經濟週期相對影響較少

而且經濟差有助他們收購重建 (主要策略), 可以擴展到其他舊區, 例如他們在大角咀有一個 project, 所以是一件好事

更正, citygate 太古 stake 只有 20%, 不值一提

太古最叻係就係整個區地提昇 value

首先 develop jor 一個 project, 再把附近重建

用之前的 project 提昇之後 projects 的 value

全部都係一步一步來

Pacific Place: 首先有 Pacific Place 1&2, 之後再在灣仔有 Pacific Place 3, 再之後有 28 Hennessy Road, 8 Queen’s Road East, 灣仔 projects 全是 3 分鐘路程之內

Quarry Bay 亦是如此, 全部商廈都是一組在一起

Mid-levels: Robinson Places, Azura, Argenta, and two other projects all within 3 mins, all on on Seymour Road

中國項目都係, 整個 complex 有 mall, hotels, offices…

不像其他 developer 只係一座一座獨立 building, 缺乏周邊配套